Best Cash Back Credit Card for Bangkokians [Thailand]

- Patrick Phang

- Apr 13, 2020

- 8 min read

Disclaimer: The article and product(s) that is/ are mentioned are non sponsored. All insights are based on personal opinions and researches done. The information would have been updated during the time you read this article. The resources are based on the day of this article being posted.

Cash back credit card is definitely the easiest card to be used out there. It requires minimum effort in getting back the value it in order to create the "worth it" value.

Hint: The best (IMO) is introduced last.

Let's see the available Cash Back credit cards in Thailand's market right now:

A. Kasikorn Mastercard Titanium

- 1% Cash back on gas, supermarket, restaurants.

- 0.25% Cash back for other categories.

- Not eligible for points earning.

- Maximum Credit refund amount at 2,000 THB per month, not more than 500 THB for each category.

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB, 6 months employment status.

• Expatriates: Minimum required monthly salary 50,000 THB.

B. UOB YOLO Platinum

- 15%* Cash back on 7-11, BTS, MRT, Boots, Watsons, Matsumoto Kiyoshi, Burger King, Shopee, Grab, Baskin Robbins, TicketMelon.

- 1% Cash back on other categories

- Annual fee at 2,000 THB**

- Not eligible for points earning

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB

• Expatriates: Not mentioned on website (statistically 50,000 THB is the minimum request for monthly salary required)

*when spending anywhere 5 times/cycle with spending 300 THB up /sale slip/time anywhere and get cash back 1% when spend less than 5 times/cycle and spending less than 300 THB/ sale slip/time

** Waived when accumulated spending hits 100,000 THB/ year

C. UOB Lady's Card

- Everyday 15% Cash back at participated department stores (Including Central Shopping Mall, Eve and Boy, Paragon, Emporium etc)

- Participated in points earning (10 THB per Reward Point for store or online from Fashion, Department Store and Super/Hyper Market- worldwide and 25 THB per Reward Point for other spending)

- Annual fee for Lady's Solitaire Card: 4,000 THB (waived for 1st year and waived with spending of 200,000 THB/ year for the following years)

- Annual fee for Lady's Card: 3,000 THB (waived for 1st year and waived with spending of 100,000 THB/ year for the following years)

- Requirements of applications:

1. LADY'S SOLITAIRE CARD

• Thais: Minimum required monthly salary at 30,000 THB, 1 year employment

• Expatriates: Minimum required monthly salary at THB 50,000

2. LADY'S CARD

• Thais: Minimum required monthly salary at 15,000 THB, 1 year employment

• Expatriates: Minimum required monthly salary at THB 50,000

D. UOB Preferred Card

- 15%* Cash back on Grab, Café Amazon, True Coffee and Dean and Deluca

*Capped maximum spending to calculate cash back 200 THB/customer/time and total amount of all participating merchants at 1,000 THB/customer/month

- Participated in points earning (15 THB per Reward point)

- Annual fee at 3,000 THB (waived for 1st year and waived with spending of 150,000 THB/ year for the following years)

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB

• Expatriates: Minimum required monthly salary 50,000 THB

E. Bangkok Bank Titanium

- Maximum of 2% Cash back

- Maximum rebate is 2,000 THB per billing cycle

- Not participated in points earning

Requirements of applications: It is not stated online, but the requirements for Thais are roughly similar as other credit cards.

For expatriates, Bangkok Bank only offers "secure credit cards". Secure credit cards work as debit card, but with the benefits of credit card itself.

Bangkok Bank required a fixed deposit account of 100,000 THB for 3 months (that cannot be withdrawn) and the bank will then evaluate if the credit card could be issued.

That is definitely not the only way. I believe if you have investments with Bangkok Bank, credit cards will be offered instead of applying.

F. KTC Cash Back Visa Platinum/ Mastercard

- Maximum of 0.8% Cash back

- Not eligible for points earning

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB

• Expatriates: Minimum required monthly salary 50,000 THB (2 years employment)

G. SCB Family Plus

- 1% Cash back, Maximum Cash back credit at 2,000 THB per month

- 4% Cash back on birthday

- What's interesting here is that SCB offers Family Plus cardholder a 1% of amount spent in every half-year (July and December) debited to his/her saving account at maximum of 500 THB (for twice)

- Annual fee: 2,000 THB per year (waived when spent 50,000/ year)

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB

• Expatriates: Minimum required monthly salary 100,000 THB (for any SCB credit cards)

H. TMB So Smart

- 1% Cash back, Maximum Cash back credit at 2,000 THB per month

- Not eligible for points earning

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB (4 months employment)

• Expatriates: not mentioned on website

I. Central Credit Card (Krungsri Bank)

These are not ordinary Cash back credit cards, but since Central Group has huge business here in Thailand, the cash back categories are quite wide. (Depends on the level of credit cards)

In this article, the multipliers of The1Points will not be covered, will be focusing on cash back sectors.

1. Central The 1 Redz:

- 5% discount: Department Stores (Central, Central Embassy and Central Online, Robinson, Payless), Supersport, Supersport Online, B2S, CMG- Central Merchant Group (including Michael Kors, Furla, Tommy Hilfiger), Muji, Mark & Spenser, CRG- Central Restaurant Group (including Pepper Lunch, Cold Stone and Yoshinoya), Foodloft, Eathai

-15% discount at Centara Hotels and Resorts

- 3% discount at Powerbuy, baan&Beyond, Thai Watsadu, Auto 1, OfficeMate

- Annual Fee at 500 THB

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB

• Expatriates: Minimum required monthly salary 50,000 THB

2. Central The 1 Luxe:

- 10% discount: Department Stores, Supersport, Supersport Online, B2S, CMG- Central Merchant Group, Muji, Mark & Spenser, CRG- Central Restaurant Group

- 5% Cash back at Central Luxury Collection (including Rinascente in Italy and ILULM in Denmark)

- 5% at Supermarket (including Tops, Central Food Hall, Family Mart, Matsumoto KiYoshi), Foodloft, Eathai, baan&Beyond, Auto 1

-15% discount at Centara Hotels and Resorts

- 3% discount at Powerbuy, Thai Watsadu, OfficeMate

- Including Priority Pass (2 visits/ year)

- Annual Fee at 4,000 THB

- Requirements of applications:

• Thais and Expatriates: Minimum required monthly salary 100,000 THB

3. Central The 1 Black:

- 10% discount: Department Stores (with lounge access, personal assistance and designated parking area), Supersport, Supersport Online, B2S, CMG- Central Merchant Group, Muji, Mark & Spenser, CRG- Central Restaurant Group

- 10% Cash back at Central Luxury Collection (including Rinascente in Italy and ILULM in Denmark)

- 5% at Supermarket (including Tops, Central Food Hall, Family Mart, Matsumoto KiYoshi), Foodloft, Eathai, baan&Beyond, Auto 1, OfficeMate

-15% discount at Centara Hotels and Resorts (CentralThe1Card Gold status, Exclusive check in, Guaranteed 13:00 hrs late check out, Room upgrades or lounge access)

- 3% discount at Powerbuy, Thai Watsadu

- Including LoungeKey (4 visits/ year)

- Thai Airway domestic flight upgrade (economy to business class) 1 time/ year

- Annual Fee at 9,000 THB (waived if spending hits 2,000,000 THB/ year)

- Invitation only

4. Central The 1 THE BLACK

- 10% discount: Department Stores (with lounge access, personal assistance and designated parking area), Supersport, Supersport Online, B2S, CMG- Central Merchant Group, Muji, Mark & Spenser, CRG- Central Restaurant Group

- 15% Cash back at Central Luxury Collection (including Rinascente in Italy and ILULM in Denmark)

- 5% at Supermarket (including Tops, Central Food Hall, Family Mart, Matsumoto KiYoshi), Foodloft, Eathai, baan&Beyond, Auto 1, OfficeMate

-15% discount at Centara Hotels and Resorts (CentralThe1Card Platinum status, Exclusive check in, Guaranteed 14:00 hrs late check out and 11:00 hrs early check in, Room upgrades or lounge access)

- 3% discount at Powerbuy, Thai Watsadu

- Including LoungeKey (Unlimited visit, limits 2 guests/ time)

- Thai Airway flight upgrade (economy to business class, Roundtrip) 2 times/ year: Once for Domestic and once for international flight in Asia

- Annual Fee at 20,000 THB (waived if spending hits 5,000,000 THB/ year)

-Invitation Only

Here are all the Cash Back credit cards offered by 7 major banks in Thailand. Most cash back are not more than 2%, which is quite disappointing.

The ones with high cash back only focus on specific sections. It is extremely rare to find an all-around cash back credit card in the market that suits for almost everybody.

The closest to perfect Cash Back credit card that I could find and strongly recommend, especially to Bangkokians is – Citi Cash Back Credit Card

Privileges:

- 11% Cash back on Skytrain & Subway

- 5% Cash back on Grab, Boots and Watsons

- 1% Cash Rebate other spendings

- 1% Rebate on Petrol*

*Every THB 800 spent/sales slip at all Shell Gas Stations nationwide

- Not participate in points earning

- Annual Fee: 2,000 THB (First year waived and waived for following years if hits spending of 60,000 THB for next 12 statement cycles)

Note:

• Total maximum cash back for skytrain & subway, Cafe Amazon, Grab, Boots and Watsons is capped at THB 500/month.

• Maximum cash back for all other retail spend is capped at THB 2,000/cycle.

- Requirements of applications:

• Thais: Minimum required monthly salary 15,000 THB

• Expatriates: Minimum required monthly salary 80,000 THB (for all Citibank Credit Cards)

What make Citi Cash Back Credit Card being on top of the list? To beat all the local banks in Thailand.

First of all, the categories of Cash Back cover almost everything that we will use. If not, it will still fall under that 1% category.

In the beginning of this article, I mentioned this card is very suitable for the ones looking for "Cash Back" in Bangkok. Especially ones who take BTS to work every day. With its' 11% cash back category, the annual fee of 2,000 THB is easily be covered.

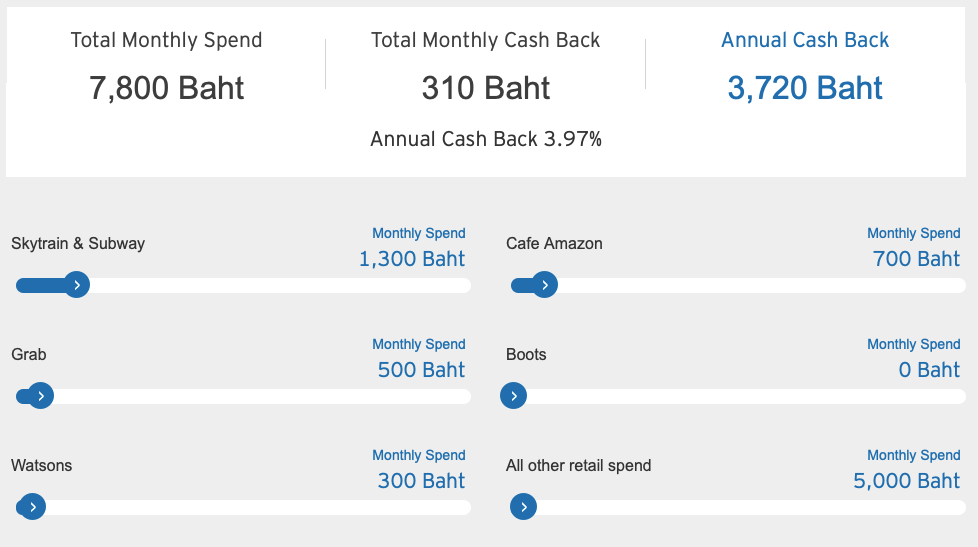

Let's take an easy example from Rainie, who is living in Bangkok. She takes BTS to work everyday and to malls in days off.

A "My Pass" of BTS for 50 rides/ 30 days, it is 1,300 THB. (note that: BTS from On Nut onward will charge additional fee, apart from "My Pass")

Let's say, Rainie orders GrabFood twice per month at 500 THB, having coffee from Amazon 3 times per week at 55 THB per time (Iced Americano), it will be a 660 THB (I placed 700 THB in calculation for some "not too strong" days). Some shampoo or make up products at Watsons for 300 THB per month. Lastly, other shopping at 5,000 THB per month.

This is somehow a "minimum spend" of average millennial who lives in Bangkok.

With all the money that Rainie would have already spent, Rainie simply saved back 1,720 THB from the calculation.

To get the most out of "Skytrain and Subway" section, there is a small "hack", which is Rabbit LINE Pay.

According to Citi Bank, Rabbit LINE Pay transactions will not be eligible for 11% and 5% cash rebate. But, users could add money/ top up the account by contacting ticketing office at BTS station. It will activate the "Sky train and Subway" category. For payments, transactions could be done through LINE Pay by selecting "My Balance". Hence, the cash back will still be credited to the account.

Moreover, Citi bank's app has easy user interface, the cardholder could easily tack how much Cash Back received.

The down side of this card is that it does not participate in rewarding program of Citibank. Hence, it loses the dynamic factor in Credit Card game.

Citi Cash Back credit card is a compact, all around cash back credit card. Highly recommend Bangkokians to apply. Suitable with lifestyle of "only one credit card" cardholder that uses all the Cash Back categories.

Of course, there is no such thing as one card suits all, because everyone has different wants and needs, that lead to different spending habits.

"Cash Back" is definitely a very straightforward benefit. It gets rid of all the hassle when looking for the best redemption with countless of calculations. But, "Cash Back" is relatively not holding the highest value among all types of cards.

Knowing your spending habits is the key in finding yourself "The Best Card".

As always, only spend money as you would normally spend. Do not be obsessed in hitting all the cash back category. As you might lose more than you earn back.

![The Best Grocery Cards [Credit Card, Thailand]](https://static.wixstatic.com/media/f8d658_e91c4f0e180d47bca5eee9fe28a60653~mv2.png/v1/fill/w_980,h_649,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_e91c4f0e180d47bca5eee9fe28a60653~mv2.png)

![The Forgotten Co-branded Hotel Card [Credit Card, Thailand]](https://static.wixstatic.com/media/f8d658_37d8d7fa367f4c92a645614d5d51c828~mv2.png/v1/fill/w_940,h_680,al_c,q_90,enc_avif,quality_auto/f8d658_37d8d7fa367f4c92a645614d5d51c828~mv2.png)

![The Most Underrated Travel Credit Card [Thailand]](https://static.wixstatic.com/media/f8d658_f63ba052bf074b4aaadfe859cd471182~mv2.jpg/v1/fill/w_980,h_735,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_f63ba052bf074b4aaadfe859cd471182~mv2.jpg)

Comments