The Most Underrated Travel Credit Card [Thailand]

- Patrick Phang

- Apr 20, 2020

- 4 min read

Updated: Apr 23, 2020

Disclaimer: The article and product(s) that is/ are mentioned are non sponsored. All insights are based on personal opinions and researches done. The information would have been updated during the time you read this article. The resources are based on the day of this article being posted.

There is no doubt that most travel credit cards in Thailand are affiliated with the national carrier- Thai Airways.

However, flying with Thai Airways somehow might not the most economical way domestically and internationally.

Let's check out the cash/ money point of view for "economical".

To have a fairer comparison, we will have the same fare condition: Business Class Flexi. Take an example of Business Class fares to Seoul, South Korea.

The fare for Asiana Airlines is 44,489.13 THB, while Thai Airways charges 51,385.00 THB.

However, on the same dates, Asiana Airlines provide a lower fare for its Business Class- Saver.

That brings the cost for flying to Seoul to be as low as 30,000 THB.

More importantly, money value does not really matter anymore in Travel Credit Card games.

What will always be on our head is the "miles value". The "economical value" of airline miles.

Let's plan a trip between Kuala Lumpur and Bangkok, without prior considerations of aircrafts, loyalty programs and alliances.

Flying with Malaysia Airlines clearly requires less miles for either Economy or Business Class.

Of course this is definitely not a fair comparison game, but it gives us an idea that "grass MIGHT be greener on the other side".

Let me introduce you the protagonist of the article today: KTC- Bangkok Airways Credit Card (non annual fee version)

The card comes with 2 variations: Visa Signature and Mastercard World. Types of payment channel do not affects the key benefits delivered, so don't worry when applying this card.

Before getting any deeper into FlyerBonus, loyalty program of Bangkok Airways, check out the benefits of KTC- Bangkok Airways Credit Card provides.

Credit Card sectors:

A. Redemption rate of 1.5 KTC Forever Points to 1 FlyerBonus Point.

B. 3x KTC Forever Points when spending in foreign currency at Bangkok Airways.

C. 2x KTC Forever Points when spending at Bangkok Airways or buying a Bangkok Airways ticket at KTC World Travel Service.

D. 2x KTC Forever Points in foreign currency transactions.

Bangkok Airways sectors:

A. Additional 10 KG of luggage.

B. 15% discount when using FlyerBonus points Redeem Bangkok Airways ticket reward.

C. 10% discount for the purchase of lounge upgrades at Blue Ribbon Club Lounge.

D.10% discount on In-Flight Shopping.

E. 5% discount on booking tour packages with Bangkok Travel Club (BTC).

But the question is, how could Bangkok Airways, the boutique airline fight against the national carrier- Thai Airways?

We will analyse this fight in two categories: Domestic and International flights.

Domestic Flights

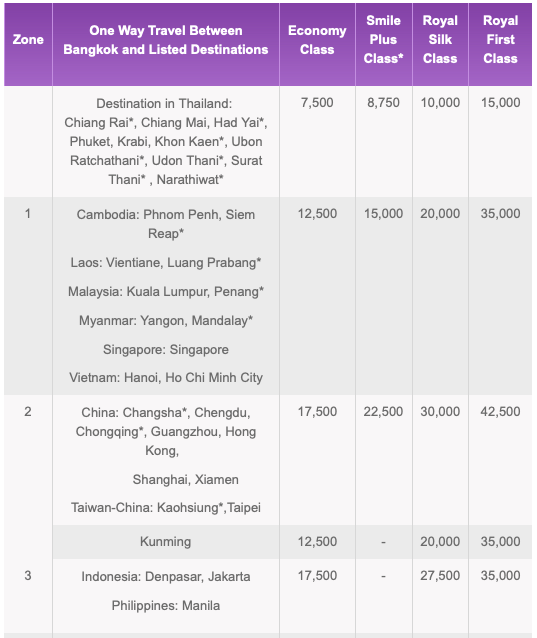

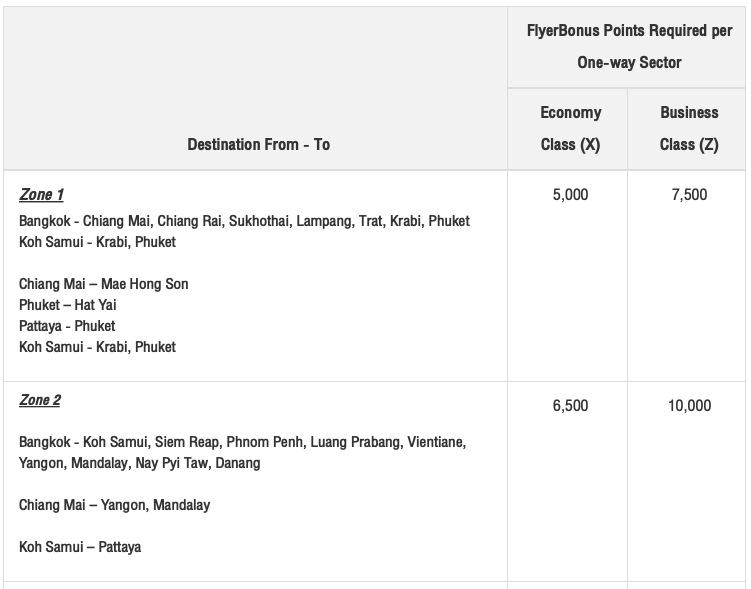

From the redemption chart of Bangkok Airways' FlyerBonus, the required points for a one way domestic economy class flight is 5,000 points (except Koh Samui for 6,500 points)

For Thai Airways, it requires 7,500 miles for domestic economy class flights' redemption.

Since Bangkok Airways is not a low cost carrier, it provides 20 KG of luggage allowance for economy class and 40 KG for business class.

Moreover, Bangkok Airways provides points redemption to Koh Samui while Thai Airways does not, provided that only these two carriers offer direct flight to Koh Samui Airport in Thailand.

From domestic section, Bangkok Airways receive a huge plus.

International Flights

Here is the tricky part. Bangkok Airways does provide international routes to Vietnam, Cambodia, Malaysia, Hong Kong etc. However, with the fleets of A319 and A320 (ATR 72-600 too), Bangkok Airways would not be competitive enough to compete with the full service airline- Thai Airways.

The trick here is, FlyerBonus allows members to redeem awards to its partner airlines: Japan Airlines, Cathay Pacific and Cathay Dragon, Etihad Airways, Qatar Airways and Emirates Airlines

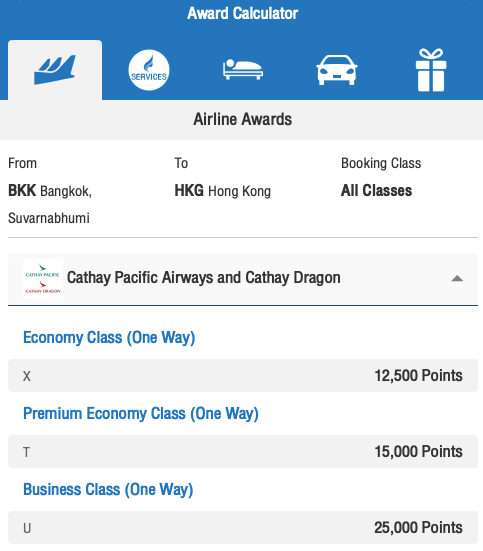

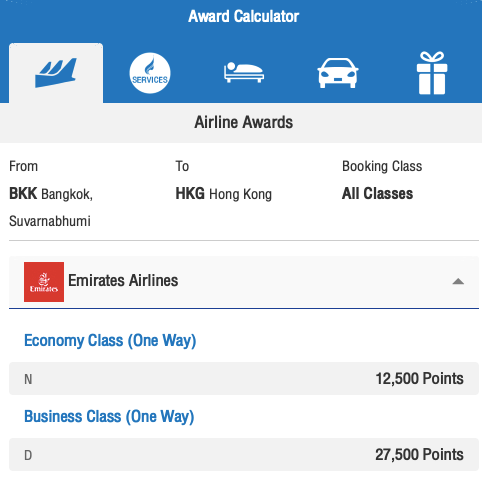

Take an example of flying to HongKong in Business Class

With redemptions of Bangkok Airways FlyerBonus points, there are 2 partner airlines available to fly with.

Emirates requires 27,500 points when Cathay Pacific requires 25,000 points for their business class products.

For Emirates, they are flying with the A380 for this approximately 3 hours' flight. Meanwhile, Cathay Pacific is flying with their A330-300. Both are amazing business class products.

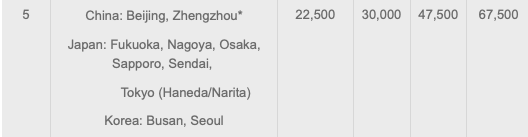

Compared to Thai Airways, the required miles is 30,000 miles for Royal Silk Class and 17,500 miles for Economy class. (referred to the reward chart above)

Bangkok Airways again, is having a Plus here.

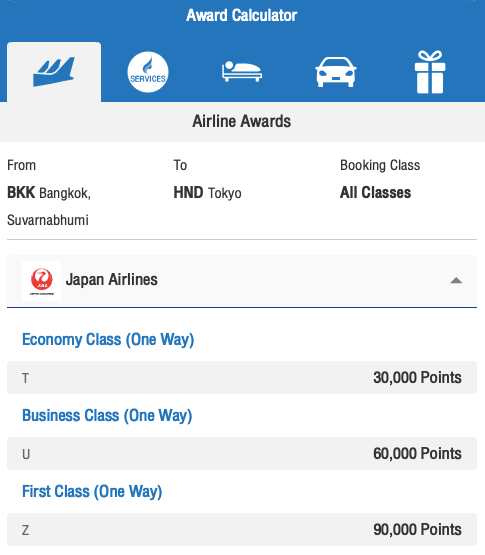

However, not every redemptions are the lowest. Take an example from Japan Airlines.

The required points for flying to Tokyo Haneda Airport is higher compared to Thai Airways.

KTC- Bangkok Airways Credit Card might not be the best travel credit card out there, but is definitely the most underrated. The partnerships Bangkok Airways has is totally under the radar of most people.

Krungthai Bank also provides different redemption channels for its' cardholders in Travel Category besides Bangkok Airways.

Ratio 1:1 (KTC Forever Point : mile/ point)

A. Best Western Rewards

Ratio 2:1

A. Big Loyalty

B. Royal Orchid Plus

C. Finnair Plus

D. IHG Rewards Club

Ratio 3:1

A. Flying Blue

B. British Airways Executive Club

C. Etihad Guest

D. Eva Air

E. Qantas Frequent Flyer

Ratio 4:1

A. Emirates Skywards

B. Miles & More Lufthansa

C. United Mileage Plus

Ratio 6:1

A. Accor Live Limitless (ALL)

The requirement for applying KTC- Bangkok Airways Credit Card (Visa Signature/ Mastercard World) is minimum monthly salary of 50,000 THB for both Thais and Foreigners.

KTC actually does provide a "Platinum" version of KTC- Bangkok Airways Credit cards.

The minimum required monthly salary for applying is then 15,000 THB for Thais. But the same 50,000 THB for foreigners.

The redemption rate of FlyerBonus point is the same at 1.5 : 1. The difference is there is no multipliers of x2 and x3. Of course, the benefits of Visa Signature and Mastercard World would not be obtained.

Keep in mind that all of these cards are having non annual fee.

The module of various redemption portals, non annual fee and lower requirements make it the most underrated travel credit card out there in the market.

With the partnerships Krungthai Bank and Bangkok Airways have, the points we hardly earn will have a better utilisation towards travelling. By doing some homework and calculations, we could indulge our next trip by sneaking through the loopholes of Thai Airways' manipulation (in Thailand).

Travel Safe, Travel Smart.

![The Best Grocery Cards [Credit Card, Thailand]](https://static.wixstatic.com/media/f8d658_e91c4f0e180d47bca5eee9fe28a60653~mv2.png/v1/fill/w_980,h_649,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_e91c4f0e180d47bca5eee9fe28a60653~mv2.png)

![The Forgotten Co-branded Hotel Card [Credit Card, Thailand]](https://static.wixstatic.com/media/f8d658_37d8d7fa367f4c92a645614d5d51c828~mv2.png/v1/fill/w_940,h_680,al_c,q_90,enc_avif,quality_auto/f8d658_37d8d7fa367f4c92a645614d5d51c828~mv2.png)

![Best Cash Back Credit Card for Bangkokians [Thailand]](https://static.wixstatic.com/media/f8d658_5af5719facfa4647a28549e85d861f92~mv2.jpg/v1/fill/w_980,h_551,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_5af5719facfa4647a28549e85d861f92~mv2.jpg)

Comments