The Forgotten Co-branded Hotel Card [Credit Card, Thailand]

- Patrick Phang

- Jun 6, 2020

- 5 min read

Disclaimer: The article and product(s) that is/ are mentioned are non sponsored. All insights are based on personal opinions and researches done. The information would have been updated during the time you read this article. The resources are based on the day of this article being posted.

Co-branded hotel credit cards are fairly popular in the States. Especially with those big BIG international hotel chains, mainly Hilton, Marriott and Hyatt.

The co-branded cards typically offer massive benefits for its cardholders. For instance, fast track to mid/ top tiers of hotels' loyalty program (which normally comes with free breakfast and room upgrades), free night certificates and earning tons of hotel points towards free nights.

Back in Asia (Just Thailand and Malaysia, my apologies! haha), I could hardly find any co-branded hotel cards. Except that one card, which is issued by Krungthai Bank. The KTC Best Western Platinum Mastercard.

Let's check out what does this only hotel co-branded credit card offer and more importantly, if it is worth it.

Overview

Benefits at Best Western

- Stay 1 night, Get 1 night free. During birth month at participated hotels in Thailand*

- 20% off Flexible rate at participating hotels in Asia.

- Extra 1,000 BWR points when book with promo code "KTCCOB"

- Complimentary room upgrade, early check in, late check out subject to availability

*List of participated hotels for free stay

Photo credit: Best Western

Other Benefits

- E-Commerce protection up to 200 USD by KTC Mastercard

- Travel and baggage insurance

- 400 THB discount at Lazada, Shopee, JD Central (online promotions by Mastercard)

- No annual fee

Hotel Points Redemption

1:1 (Min 1,000 KTC Forever points = 1,000 Best Western Rewards points)

Requirements

- Minimum monthly income of 15,000 THB for Thais and 50,000 THB for foreigners.

Brand Overview

Best Western hotels and resorts has a global network of approximately 4,700 hotels in 100+ countries and territories. With 18 brands under Best Western's portfolio, it offers properties ranging from upscale (eg. Best Western Premier) to economy (eg. SureStay Hotel by Best Western)

Coverage of Best Western properties:

Photo credit: Best Western

Currently, there are 13 Best Western properties in Thailand, located at Bangkok (6), Phuket (4), Chiangmai (1), Buriram (1) and Prachinburi (1). With 3 upcoming properties in Pattaya. The room rates of Best Western are ranging from approx. 2,000 THB to approx. 8,000 THB per night.

Photo Credit: Best Western Premier Bangtao

Best Western Premier Bangtao Beach Resort is definitely having the highest rate throughout the year among all the BW properties in Thailand, because of its destination and brand positioning.

Loyalty Program

The most crucial part of committing ourself to a hotel chain is indeed the loyalty program. For Best Western, it's called Best Western Rewards.

Photo Credit: Best Western

From the chart, it is obvious that there is not much perks being as top tiers of Best Western Rewards. Mainly because the brand offer limited services in its properties. Unlike Hilton or Marriott that could offer executive lounge access, suite room upgrades on their upper upscale and luxury properties.

However, the points redemption rate of Best Western Rewards is extremely obtainable. Starting as low as 5,000 points for 1 night stay.

It makes Best Western a lot more approachable compared to other chain. Points wise and price wise. Not a complaint, at all.

Unfortunately, the co-branded KTC credit card does not offer the cardholder a fast track to higher tier. It would be great if fast track is offered. It will definitely encourage the cardholders staying in Best Western property, to get that extra bonus points towards free stay.

Example of Comparison

Remember we mentioned Best Western is much more approachable earlier?

Let's take a comparison of its property with an IHG property in Chiangmai.

To make this comparison as fair as enough, we select room rates including breakfast and with higher flexibility of cancellation. Both are rated as 4 stars hotel.

Period of stay: 31 Dec 2020 to 1 Jan 2021. Busy season indeed, New Year's Eve.

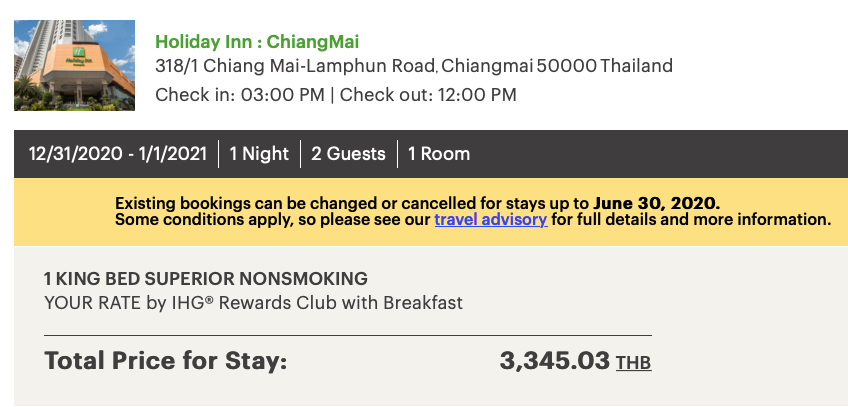

Holiday Inn Chiangmai

Photo Credit: Holiday Inn

Holiday Inn, the representative of comparison property from IHG. It takes 20,000 points (excluding breakfast, tax and service charge) or 3,345.03 THB (including breakfast) nett for one-night-stay.

Best Western Prime Square Hotel

Photo Credit: Best Western

The minimum points required is 16,000 (with breakfast and tax included). Meanwhile, to pay with the co-branded credit card, it is 2,480 THB nett. With minus 2 days of cancellation. Still a great flexibility.

Best Western Prime Square is actually located right in the city centre of Chiang Mai, nearby Soi Niman. While Holiday Inn is 15 minutes drive away from the crowded street, located right beside the Ping river.

Still not an apple-to-apple comparison, but good enough to show a big picture.

Worth it?

This card is basically applicable by everyone, who has an empty slot in their cardholder/ wallet.

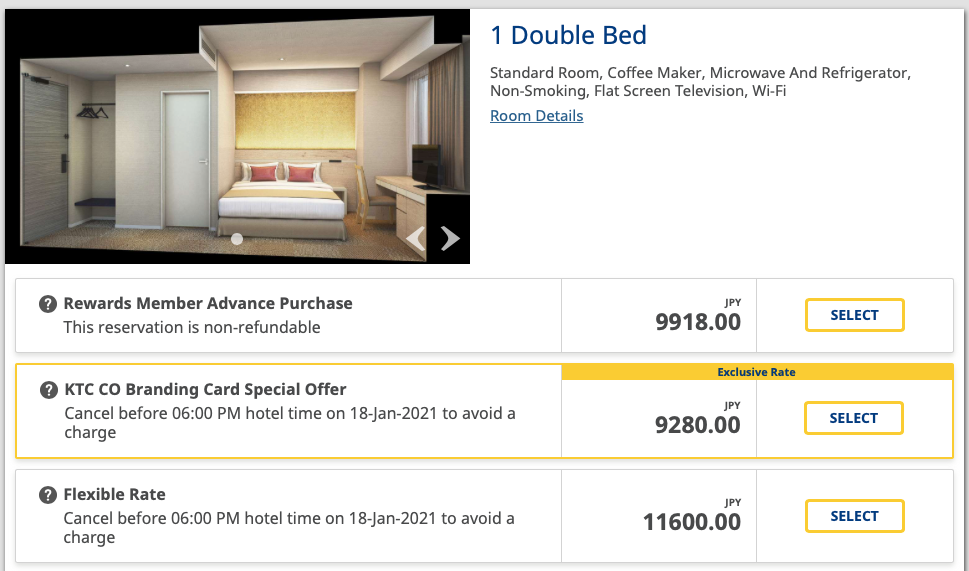

Since it is a 0 annual fee credit card, there is not much to worry for. The value could easily obtained, by using it once a year for that 1-night-free in birth month. Don't forget the 20% discount is offered for stays in Asia. A great way to save a little extra while travelling around expensive cities, such as Tokyo.

Here is a random search (19 Jan-20 Jan 2021, Tokyo)

The lowest rate available for Best Western properties in that period of stay on this search is Best Western Hotel Fino Tokyo Akasaka (400 meters away from the nearest subway station). With co-branded card, it offers an additional 600 THB discount from its 3,000 THB room rate.

Definitely worth it. Probably worth 2 bowls of ramen in Tokyo.

Bottom Line

The KTC- Best Western Platinum card is definitely not the best card for hotel stay. But with the relatively low requirements and values added, it is indeed a card that we will say "why not?" for. A great "just in case" card for hotel stays.

To mention again, it will be a cherry on top if fast track elite status is offered. Maybe not the highest tier, but from mid tier. It will definitely be a win-win-win situation. For customers, credit card issuers and hotel itself.

This is a non annual fee card, I wouldn't expect there is any multipliers. But, it will be much appreciated if it is available, such as 2x BWR points when spending at Best Western properties. Again, another win-win-win strategy.

However, with the redemption rate of 1:1, it could be a reason to have this card as your daily card. Only if you are very loyal to Best Western and have no other cards with additional multipliers towards better redemption. Hotels wise or airlines wise.

There are plenty of co-branded airlines cards out there, it will be great if we could see more co-branded hotel cards offered to Asia market.

![The Best Grocery Cards [Credit Card, Thailand]](https://static.wixstatic.com/media/f8d658_e91c4f0e180d47bca5eee9fe28a60653~mv2.png/v1/fill/w_980,h_649,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_e91c4f0e180d47bca5eee9fe28a60653~mv2.png)

![The Most Underrated Travel Credit Card [Thailand]](https://static.wixstatic.com/media/f8d658_f63ba052bf074b4aaadfe859cd471182~mv2.jpg/v1/fill/w_980,h_735,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_f63ba052bf074b4aaadfe859cd471182~mv2.jpg)

![Best Cash Back Credit Card for Bangkokians [Thailand]](https://static.wixstatic.com/media/f8d658_5af5719facfa4647a28549e85d861f92~mv2.jpg/v1/fill/w_980,h_551,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/f8d658_5af5719facfa4647a28549e85d861f92~mv2.jpg)

Comments