Is Annual Fee Worth Paying? [Insight]

- Patrick Phang

- Apr 16, 2020

- 5 min read

Disclaimer: The article and product(s) that is/ are mentioned are non sponsored. All insights are based on personal opinions and researches done. The information would have been updated during the time you read this article. The resources are based on the day of this article being posted.

When we are trying our best in squeezing out all the benefits and perks provided by credit cards, the issuers never just sit back and let it happens. "Throw a brick to attract a jade" is a common tactic used by credit card issuers to attract more users. That's an old Chinese saying that describe the best of our love-hate relationship with credit cards' annual fee.

Yes, the existence of annual fees sometimes just feel....ridiculous. The range of annual fees could be ranged from 200 THB up to 35,000 THB.

Basically all the top tier credit cards come with an annual fee. These cards are typically offering some perks towards travelling. For example, airport lounge access, great points conversion rate towards airline miles and limousine service.

Let's take an example of an American branded bank exists in Thailand- Citi Bank.

The Citi Prestige Credit card has an annual fee of 8,453 THB. It is almost 50% of the minimum monthly wages in Thailand*.

Meanwhile, the American Express Platinum card comes with annual fee of 35,000 THB. It is worth a month salary of an average secretary.

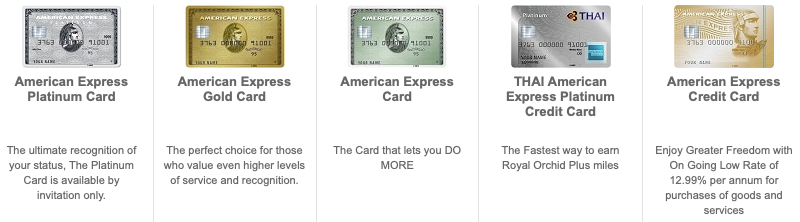

However, not just "Top Tiers" credit cards come with annual fee. Let's take a lot of another card from American Express.

Despite the big brand of American Express, the "American credit card" is advertised as "lower interest rates and usage fees of just 12.99% per year for purchases of goods and services. When you choose to pay the minimum monthly amount"

That is definitely not a good advertising content. As we had learned that in credit cards' game, we must, we should, we have to pay for full every month to avoid any chances that interest would be occurred. If not, we are playing the game wrong as we are paying something unnecessary.

Even so, it comes with an annual fee of 1,926 THB.

The question is "If annual fee is worth paying?"

The answer for this question is vary. It is both yes and no. As every users have different spending habits. There is no specific answers.

Let's start with why would it be "Worth It" for paying that extra money.

The "Worth It" factor only existed when cardholder receive positive value EVERY YEAR, from the expense that would have already spent. Don't be fooled by the welcome bonuses (52,000 points etc), as it is only provided once. Unless the cardholder plans to cancel the card on the very next year. It is doable, but not recommendable, as it will ruin the relationship between cardholders and issuers. With negative relationships, the credit card issuers would most probably reject the next applications.

Take a look at the Citi Prestige Credit Card.

As "reward points" is a floating category, that the value of points might vary due to the types of redemption, we will analyse the straight forward benefits first.

1. Unlimited airport lounge access from Priority Pass:

Priced at 429 USD per year. It is already worth 14,000 THB.

If the card holder is a frequent traveller, the offer of Priority Pass itself had already exceeded the break even point of paying annual fee.

2. Complimentary Airport Transfer:

Let's take a popular route from Suvarnabumi Airport to Thonglor area in Bangkok.

The price of Toyota Camry is 1,200 THB from AOT Limousine Service, a very average price for limousine. Of course, as "Prestige", it might go all the way up to Mercedes Benz or BMW.

The (lowest) value of this is approximately 2,400 THB.

3. Complimentary 4th Night at participating hotel:

This is indeed a difficult one, as the list of participated hotels are not disclosed online. However, the average room rate for luxury hotel is around 300 USD* (approx 9,800 THB)

With just these key benefits, the card holder could simply get the value of approximately 26,000 THB.

Formula: Worth It = Value - Annual Fee

Worth It = 26,000 - 8,453 THB

= 17,547 THB

For the "worth it" factor, it is indeed positive, even before any points redemption.

From the previous article, we realised that the points value is used to the max when being redeemed for travel.

For Citi Prestige, the conversion rate to the popular ROP Milage Program (Thai Airways Royal Orchid Plus) is 2:1. The value of 0.3 THB per point could simply be earned.

Last but not least, as this is the highest tier card that Citi offers, it comes with other perks. For instances, reserved parking, dining privileges and gym access at participating hotels and personal assistance.

From these benefits and quick calculation, this card is worth paying the annual fee. If the card holder utilise all the benefits.

On the other hand, let's see why would an annual fee not worth been paying for.

Take the example from American Express (Thailand).

Specifically, the American Express Gold Card.

It is advertised as "The perfect choice for those who value even higher levels of service and recognition".

It comes with annual fee of 3,210 THB for that extra recognition.

The card itself has exact the same category of benefits compared to the American Express Green Card (annual fee of 1,765.50 THB): Travel Insurance, Purchase Protection and the same points earning rate of 25 THB per Membership Rewards Point.

The main differences are higher insurance coverages and that the Gold Card offers Refund Protection and Price Protection.

If not much huge purchases are made, this additional 50% (approximate) of annual fee will not be much more beneficial, compared to American Express Green Card.

It is so disappointing that American Express (Thailand) did not offer any multipliers for high tiers' charge card. The Gold and Platinum card.

Compared to Citi Bank that listed down all the physical benefits, American Express provides only "Insurances" for the products line up, except American Express Platinum Card which is another story as it is invitation only and comes with annual fee of 35,000 THB.

These factors make the American Express Card annual fees not easy to be utilised.

Check out my article about American Express in Thailand for more detail. [Read More]

In conclusion, is annual fee worth for paying?

The answer is "YES", if the cardholder utilise all the benefits the credit card issuers provide.

The answer is also "NO", if the cardholder does not use any benefits at all which the credit card issuers provide.

If the benefits offered are not utilised, it will never be "Worth It" although it is a high tier card.

Imagine if someone who travels once per year, the value of Priority Pass from Citi Prestige Credit Card will be dropped from 429 USD to 163 USD (5,300 THB), which is not "Worth It"* at all for paying the annual fee.

*Provided that the user uses only Priority lounge, twice for roundtrip travel (99 USD Membership fee + 32 USD per visit)

If you are new to Credit Card games, start with some non annual fee cards (or with annual fees that can be waived by phone calls). Observing how the redemption or cash back system works and climb up the ladder for higher tier cards that suit your spending habit.

There is no the best card, only the ones that suit you.

Find your own "best card" and maximise its' value. Having the value surpassing the annual fee, it will be worth it.

![Why I Cancel My Debit Card Without Thinking Twice. And You Should Too [Insights. Thailand]](https://static.wixstatic.com/media/f8d658_e064976240fa45e19f49afdbcbd9dc67~mv2.png/v1/fill/w_532,h_513,al_c,q_85,enc_avif,quality_auto/f8d658_e064976240fa45e19f49afdbcbd9dc67~mv2.png)

![Should I Buy Miles/ Points? [Airlines, Hotels]](https://static.wixstatic.com/media/f8d658_827a7e032143448a8fabe1b817696690~mv2.png/v1/fill/w_740,h_514,al_c,q_90,enc_avif,quality_auto/f8d658_827a7e032143448a8fabe1b817696690~mv2.png)

Comments