American Express in Thailand

- Patrick Phang

- Apr 11, 2020

- 4 min read

Updated: Apr 12, 2020

Disclaimer: The article and product(s) that is/ are mentioned are non sponsored. All insights are based on personal opinions and researches done. The information would have been updated during the time you read this article. The resources are based on the day of this article being posted.

American Express holds a unique spot in my heart, as it is always on the premium side of credit card categories.

American Express is the company being both credit card issuers and payment channel.

It is widely advertise in movies and word of mouth too, especially the American Express Centurion card, aka the black card.

As I am currently based in Thailand, American Express Thailand does not really pull the trigger, letting me apply one of its product.

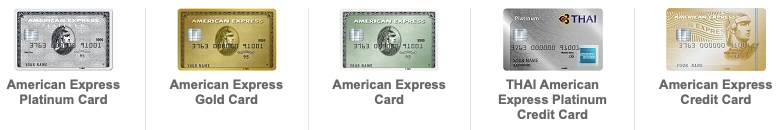

Let's dive into what products are offered by American Express:

The line up includes 2 Credit Cards (THAI American Express Platinum Credit Card, American Express Credit Card) and 3 Charge cards (American Express Platinum Card, American Express Gold Card and American Express Card-Green).

The main difference between these two, is that Charge card has no spending limit. All you need to do is pay off what you had spent each month. That means the user ought to be more responsible.

This is crucial for some, as credit card normally has a spending limit up to 2 or 3 times of the cardholder's monthly salary. If the purchase is over the spending limit, one would need to make it by cash or any other method. This would lose the opportunity for earning credit card points. Even if he/ she spent the max of the card's credit limit, this would only hurt his/her credit scores.

American Express is well-known with its' charge card products. With the history it has since 1850, there is no doubt that American Express has becoming the giant in this industry.

However, the products that it offers in Thailand is not the best.

Starting with American Express Card (aka the green card), it is the starter card for playing the charge card game. But, it comes with the annual fee of 1,765.50 THB. For me, it is totally unreasonable. In Malaysia, the annual fee of green card is "0" and even come with 2x Membership Rewards points per RM spent*.

What's more hilarious would be the American Express Gold Card, it has an annual fee of 3,210 THB. It has no multipliers in any category. The only "better"** benefits are additional 0.5 million travel insurance and refund protection.

In the States***, American Express Gold offers 4x Membership Rewards points on dining worldwide and US Supermarket, 3x when spending on flights booked directly with airlines or on amextravel.com , 120 USD for dining credit and 100 USD for Airline Fee Credit. Although it has an annual fee for 250 USD (8,172.50 THB), the package that comes with it is definitely "worth it", if you spend those money as you would normally spend. Plus, it is a METAL card.

For the American Express Platinum Card, the most premium card offers. It comes with annual fee of 35,000 THB. No multipliers too. But it provides all the premium service for each Platinum Cardholder will receive (eg. Airport Lounge access, Fast Trace Gold Member for Hilton Honors and Marriott Bonvoy)

All the American Express cards issued in Thailand are in plastic. Even for the Platinum.

****Metal Platinum card will be issued starting from Q2 of 2020 in Thailand.

Another card that I would like to highlight is the THAI American Express Platinum Credit card.

From my researches on Pantip (A well known Thai forum), it used to be much useful back then.

THAI American Express Platinum Credit card comes with an annual fee of 4,280 THB.

As it is an airline affiliated credit card, it has a superb conversion rate of miles: 1 ROP miles per 25 THB.

Additional miles and Fast Track Royal Orchid Plus Gold status will be the key benefits.

Please see the captured info as below:

This card is suitable for whom flies a lot, especially with Thai Airways and have huge spending throughout the year. If not, it is not an easy task to utilise all the benefits it offers.

The reason why I would still recommend for applying American Express in Thailand is the value of its' points.

From the article about Citibank Rewards, we learnt that the conversion of points to mile is ridiculously low. Click on the link for more details. [Here]

As its' competitors, the points earning rate is 25 THB per Membership Rewards point (MR points).

For American Express credit and charge cards, the points to miles conversion is: 2 MR Points : 1 Mile and 1.5 MR Points :1 Mile for Platinum cardholders.

The participating airline companies including Singapore Airlines KrisFlyer, British Airways Executive Club, Emirates SkyAwards and more.

Remember Krungthai offers airline miles conversion for these airlines too? But the conversion rate is 3:1 to 4:1 [Read Here]

Moreover, it provides points transfer to hotels' loyalty programs. Hilton Honors at (1.25 : 1) and Marriott Bonvoy (1:1) conversion.

With the transfer program American Express has, it helps the user to maximise the value of every points earn. Thus, the "Worth It" value is increased.

However, there are no multipliers offered in Thailand. It makes me hold back on the application. Plus, the annual fee for even green card stops me in getting the American Express sector.

If it provides multipliers on the Gold Card as how the States did, I will defiantly go on for the application. Only if.

In conclusion, American Express Credit Cards and Charge Cards in Thailand are definitely "Worth it" to apply for, if you have huge annual spendings (Even in Malaysia). The Credit history that the users have with American Express will be recorded. In case if the user is switching country of residence, it will be easier for obtaining a new American Express Card in that new country.

Then, it will be the time for him/her to step up the credit card points and miles games.

As mentioned before, it is a long lasting game. Don't be hurry in getting into the big leagues. Find your way, utilising everything you have, be prepared when your time is coming.

Source****: https://www.americanexpress.com/th/en/charge-cards/thai-platinum-card/

![Why I Cancel My Debit Card Without Thinking Twice. And You Should Too [Insights. Thailand]](https://static.wixstatic.com/media/f8d658_e064976240fa45e19f49afdbcbd9dc67~mv2.png/v1/fill/w_532,h_513,al_c,q_85,enc_avif,quality_auto/f8d658_e064976240fa45e19f49afdbcbd9dc67~mv2.png)

![Should I Buy Miles/ Points? [Airlines, Hotels]](https://static.wixstatic.com/media/f8d658_827a7e032143448a8fabe1b817696690~mv2.png/v1/fill/w_740,h_514,al_c,q_90,enc_avif,quality_auto/f8d658_827a7e032143448a8fabe1b817696690~mv2.png)

Comments