Insane Mileage Redemption rate • Standard Chartered [Credit Card, Malaysia]

- Patrick Phang

- May 10, 2020

- 3 min read

Disclaimer: The article and product(s) that is/ are mentioned are non sponsored. All insights are based on personal opinions and researches done. The information would have been updated during the time you read this article. The resources are based on the day of this article being posted.

Remembering the redemption rates of HSBC bank, that offers redemption rate of 18:1 for Malaysia Airlines Enrich mile and 25:1 for Singapore Airline Krisflyer Mile. Thanks to some multipliers offer, it is not the worst reward program out there.

Today, we are going to have a deeper look into what Standard Chartered bank offers for its products in Malaysia, in term of reward points.

Standard Chartered bank offers 2 types of reward program. WorldMiles Point specially for one card and 360° Reward Point for the rest of the lineup.

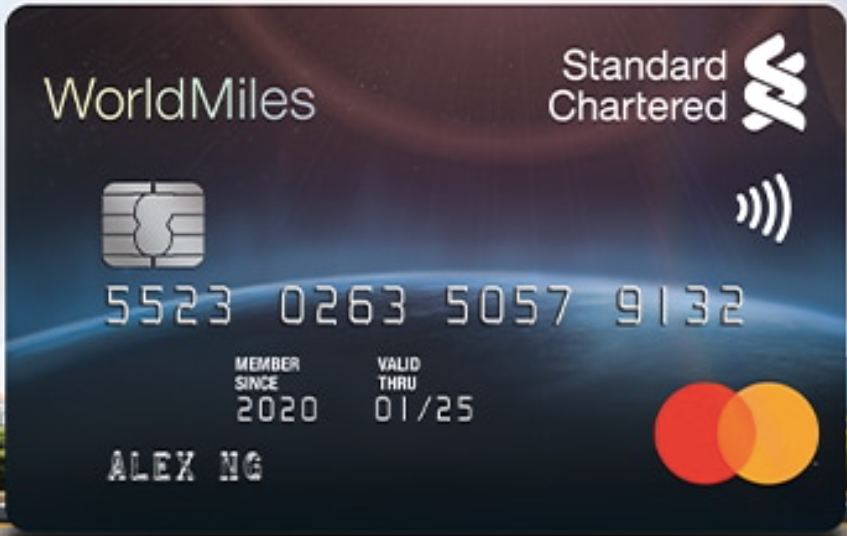

A. WorldMiles Mastercard

This is the only card earning WorldMiles Point. Pretty straightforward from its name.

Earning rate

3 MYR local spend = 1 WorldMiles Point

3 MYR overseas spend = 4.5 WorldMiles points

Redemption Rate

2 WorldMiles Points = 1 Airline Miles*

*Partnered Airlines: Airasia Big Points, Asia Miles, Malaysia Airline's Enrich, Singapore Airline's Krisflyer.

Benefits

- Plaza Premium Lounge access at KLIA and KLIA2 when travelling internationally

- 80 MYR cash back on airport ride (Airport Limousine, KLIA Ekspress) after 3 swipes on foreign currency

- Up to 200 USD E-Commerce protection

- Exclusive offers for stay at participated Banyan Tree Hotels & Resorts

Annual Fee 600 MYR

First year waived. Waived for subsequent years when spend 60,000 MYR per annum

Eligibility

Minimum Annual Income of 90,000 MYR

Now, there will be 3 tiers for cards earning 360° Reward Point.

B. Priority Banking Visa Infinite Card

Earning rate

5x on foreign currency spending

1x on local currency spending

Here is an interesting points earning** for this privilege card:

40 points per 10,000 MYR outstanding balance for Home loan/ house financing

40 points per 10,000 MYR average balance for investment, current and/or saving account, secured overdraft

5 points per 10,000 MYR fixed deposit/ General Investment Account-I

**Capped at each month 4,000 points for each category

Redemption Rate 7 : 1

*Partnered Airlines: Airasia Big Points, Asia Miles, Malaysia Airline's Enrich, Singapore Airline's Krisflyer.

Benefits

- LoungeKey for international lounge access

- 12x "80 MYR" cash back on airport ride (Airport Limousine, KLIA Ekspress) with 3 swipes on foreign currency in the past 30 days.

- Complimentary Accident and Medical insurance

- Exclusive privileges at Golden Screen Cinema, Banyan Tree Hotels & Resorts and selected Fine Dining restaurants

- Visa Infinite privileges: Eg. 1 complimentary night for every 3 paid nights and more.

Annual Fee 800 MYR

First 2 years waived. Waived for subsequent years when spend 10,000 MYR per annum

Eligibility

Priority Banking members with a minimum Assets Under Management of 250,000 MYR per month

C. Visa Platinum Card

Earning rate

5x on dining, department store and foreign currency spending

1x on other local currency spending

5,000 bonus points with monthly spending at 1,500 MYR

Benefits

- Exclusive 1-for-1 dining deals via the Entertainer

- No annual Fee

Eligibility

Minimum Annual Income of 36,000 MYR

D. Platinum Mastercard Basic Rewards Credit Card

Earning rate

1x for every MYR spend

Benefit

- No annual fee

Eligibility

Minimum Annual Income of 24,000 MYR

Well, Standard Chartered Bank does not publicise the redemption rates for its lower tier products (Visa Platinum and Platinum Mastercard).

Hence, some mileage redemption rate could be obtained from the airlines' websites.

Here you go.

AirAsia BigPoints 10:1 (Min 10,000 points : 1,000 Miles)

Malaysia Airlines Enrich 46:1 (Min 46,000 points : 1,000 Miles)

Final Thoughts

Don't be surprise, it is indeed 46 points for 1 Enrich mile, at the final description. In other words, it takes spending of 46 MYR to earn 1 mile for low tier cards. It is indeed insane.

The redemption rates offered by higher tier cards are reasonable, but yet might not be the best products out there.

If users who are focusing on starter travel cards in Malaysia, my advice is trying to stick with an airline. HongLeong Bank AirAsia credit card is definitely one of the best options for low cost airlines. While, CIMB Enrich Credit Card is offering better redemption rate of 46:1.

Don't worry about starting slow. Optimise and Utilise what we have are the keys towards better travel.

Have a glance of estimated earning miles by using the excel file below:

By inserting the amount of expense in Yellow Column

![No Introduction Needed • American Express [Credit Card, Malaysia]](https://static.wixstatic.com/media/f8d658_36e456df38144feab69cba6ea8858186~mv2.png/v1/fill/w_571,h_432,al_c,q_85,enc_avif,quality_auto/f8d658_36e456df38144feab69cba6ea8858186~mv2.png)

![The Best Looking Card • [Credit Card, Malaysia]](https://static.wixstatic.com/media/f8d658_5d3940dfb7bf46258a6b8ccbbb643e41~mv2.png/v1/fill/w_847,h_634,al_c,q_90,enc_avif,quality_auto/f8d658_5d3940dfb7bf46258a6b8ccbbb643e41~mv2.png)

![Starting from Mid-Tier • UOB [Credit Card, Malaysia]](https://static.wixstatic.com/media/f8d658_07c43b4aa9ef4e9ebf15250e2d03964f~mv2.png/v1/fill/w_719,h_482,al_c,q_85,enc_avif,quality_auto/f8d658_07c43b4aa9ef4e9ebf15250e2d03964f~mv2.png)

Comments